36 355 spin off diagram

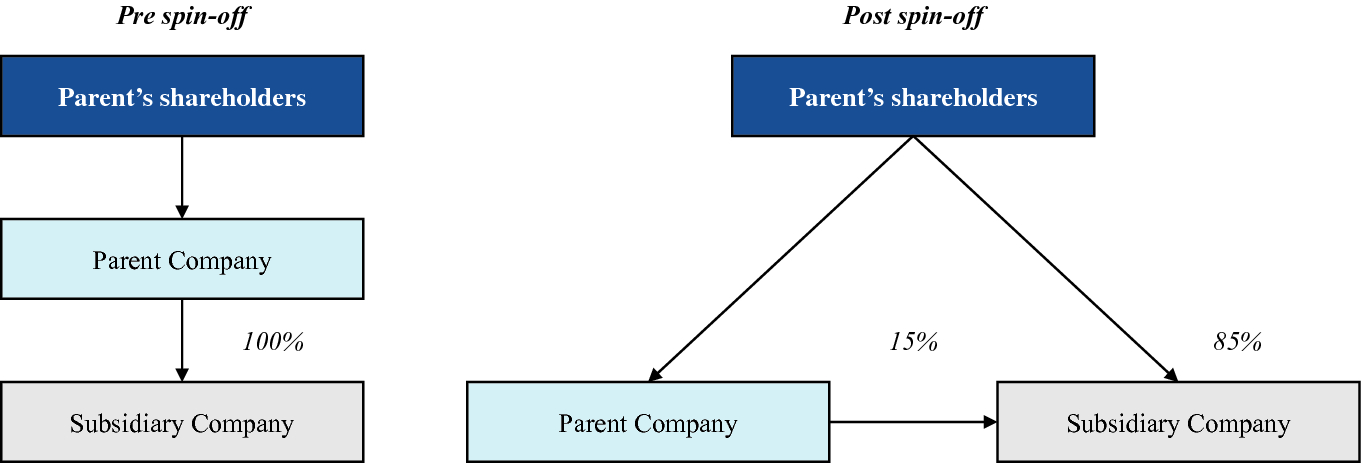

April 3, 2021 - A corporate spin-off is an operational strategy used by a company to create a new business subsidiary from its parent company.

See also Treas. Reg. section 1.355-2(d)(5)(v), Ex. 2. • Exception presumably concerned with economically similar transaction where D splits off C where C has 2 or more businesses and then C contributes a business to C1 and spins off C1 pro rata to the shareholders split off from D. • What does “ordinarily” mean?

– Section 361(b)(3): If, in a D/355 spin-off transaction, a distribution of boot to D is used to pay creditors of D, then no gain is recognized to the extent the value of the boot does not exceed the basis of the assets contributed to C in the reorganization.

355 spin off diagram

Needless to say, that’s a great result for the Star Wars spin-off, beating the studio’s pre-release guidance, and hitting or exceeding the numbers that most in the industry were expecting. Our model predicted $151 million as of yesterday morning, so the film is maintaining its momentum through the weekend, and there are some reasons to believe that Rogue One may beat …

There are three primary methods of dividing a corporation tax-free: (1) spin-off, (2) split-off, and (3) split-up. A spin-off is a pro rata distribution of a controlled corporation's stock to the distributing corporation's shareholders without requiring the shareholders to surrender any of their stock in the distributing corporation.

PLR 201330002 - Code §355 spin-off and reorganizations of foreign and domestic corporations owned by a U.S. parent corporation. Code §368(a)(1)(D). PLR 201330006 - Controlled foreign corporation's ("CFC's") distributive share of income from a foreign partnership is not includable in foreign base company income. Code §954.

355 spin off diagram.

Section 355(e) of the Internal Revenue Code is particu-larly relevant to M&A activity — under that section, if 50% or more of the vote or value of the distributing par-ent or the spun-off subsidiary is acquired as part of a "prohibited plan" with the spin-off, the spin-off is taxable to the distributing parent (but not to its stockholders).

Acquiring's stock must be distributed in a spin- off that qualifies under § 355. "Control" test looks to § 368(c) definition. Acquisitive D Reorganizations. Acquiring must acquire "substantially all" of the assets of Transferor. § 354(b)(1)(A). Definition of "control" looks to § 304(c): • Control = 50% vote or value

In a Section 355 divisive transaction, a corporation usually distributes stock of one or more controlled subsidiaries to its shareholders without gain ...

split-off. If the Code Sec. 355 transaction is a split-up, the tax attributes of distributing company (which liquidates) will disappear. The tax attributes of the controlled company should not be affected. What a Spin-off Does Not Do A spin-off is a great way to divide a corporation and get stock of the spun-off corporation into

September 9, 2015 - The stock of the subsidiary corporation ... in the diagram below, though not in reality (I'll explain soon) -- is referred to as Controlled. Now that you have the necessary foundation, we can discuss what Yahoo would have to do to make the spin-off tax-free. If you were to open the Code to Section 355 (you won't) ...

September 17, 2020 - In addition, the parent corporation is taxed on the built-in gain (the amount the asset has appreciated) in the stock of the subsidiary. Section 355 of the Internal Revenue Code (IRC) provides an exemption to these distribution rules, allowing a corporation to spin off or distribute shares ...

A spin-off is usually tax-free under Internal Revenue Code (IRC) Section 355, meaning that no taxable gain is recognized by either the parent entity or the parent's existing shareholders. To qualify for favorable tax treatment, the spin-off must meet the requirements of Section 355:

October 30, 2018 - Gibson, Dunn & Crutcher, with more than 1,300 lawyers in 20 offices in major cities throughout the United States, Europe, the Middle East, Asia and South America, is committed to providing the highest quality legal services to its clients.

Need to fix your 34-670 Type 2 10 Inch Table Saw? Use our part lists, interactive diagrams, accessories and expert repair advice to make your repairs easy.

A tax-free corporate division may take the form of a spin-off, spilt-off, or a spilt-up. It may also be a divisive Type D reorganization. Spin-off. A spin-off involves the distribution of stock of the Controlled Corporation, on a . pro rata. basis, to the Distributing Corporation’s shareholders. After the spin-off, the

spin-off. Section 355(f) generally serves to prevent the duplication of gain (and, in some cases, of loss) in the context of a multi-step transaction where an intra-group spin-off is followed by an external spin-off. Consider, for example, a structure in which the

May 31, 2021 - A spin-off in the U.S. is generally tax-free to the company and its shareholders if certain conditions defined in Internal Revenue Code 355 are met. One of the most important of these conditions is that the parent company must relinquish control of the subsidiary by distributing at least 80% ...

This is evidenced by the much higher on/off ratio and the observed bipolar transport behavior. ... The schematic diagram of the spin FET is simply presented in Figure 5(c), in which the drain/source electrodes are made from ferromagnetic materials for the spin polarizer and analyzer of electrons along the current-flow direction. The spin FET constructed by using 2D magnet 2H …

wiring diagram – qsm11 (marine) 3666468: 329: wiring diagram – ism series: 3666269: 330: wiring diagram – qsm11 : 3666413: 331: operation and maintenance manual – qsm (industrial) 4021942: 332: operation and maintenance manual – qsm (marine) 4021940: parts for cummins m11, l10, ism, and qsm engines: 333: air control valve – ism / qsm / isx / qsx / m11: 3770742: …

the distributing or a spun-off corporation, and that interest is attributable to stock purchased within the five-year period before the distribution. In an apparent attempt to mitigate the breadth of section 355(d), Congress granted the Treasury Department ("Treasury") authority to issue

• Blackstone on its 2019 corporate conversion, 2015 spin-off of its financial advisory businesses and 2007 sale of $3 billion of non-voting common units to a sovereign wealth fund established by the People's Republic of China • Dover Corporation in the 2018 spin-off of its upstream energy business into a standalone, publicly-traded company

Upholding tax-free treatment for both the spin-off (under Section 355) and the reorganization (under Section 368(a)(1)(A)), the Fourth Circuit held that facilitating the subsequent merger ...

January 17, 2020 - When our analysts dug into the numbers, we found companies that were spun off over the past decade under-performed the S&P 500 by 2.7 percentage points per year on average. So how can investors profit from this once dependable source of market beating investment ideas?

Binary boiling point diagram of two hypothetical only weakly interacting components without an azeotrope. Most volatile compounds (anywhere near ambient temperatures) go through an intermediate liquid phase while warming up from a solid phase to eventually transform to a vapor phase. By comparison to boiling, a sublimation is a physical transformation in which a solid …

7. Dimension 3 DISCIPLINARY CORE IDEAS—EARTH AND SPACE SCIENCES. E arth and space sciences (ESS) investigate processes that operate on Earth and also address its place in the solar system and the galaxy. Thus ESS involve phenomena that range in scale from the unimaginably large to the invisibly small.

24.04.2008 · Two of the hottest topics in fundamental condensed matter physics are relativistic Dirac particles and the quantum spin Hall phase. Materials that realize either one of these phenomena are scarce ...

The regulations state that “Section 355 applies to a separation that effects only a readjustment of continuing interests in the property of [D and C].” This requires that, after the Distribution, “one or more persons who . . . were the owners of” D before the Distribution – i.e., Client and Departed – “own, in the aggregate, an ...

For a split-off transaction to qualify under Sec. 355 (and require no recognition of gain or loss by a shareholder), it must meet four requirements: a. The first requirement under Sec. 355(a)(1)(B) is that the transaction is not used principally as a device for the distribution of the earnings and profits of the distributing corporation or the ...

December 2, 2020 - PICPA members get full access to all of our articles, forums, podcasts, and more · Try it out! Start a free 7 day trial for member access. No credit card required

by GN Kidder · Cited by 7 — This article describes the basics of U.S. tax-free spin-off transactions under section. 355, including the U.S. tax consequences, requirements, restrictions and ...10 pages

A spin-off or split-off is generally completed in a manner that is non-taxable to the companies and to the shareholders receiving the spin-co shares. The tax rules relating to spin-offs and split-offs are complicated, and tax attorneys should be consulted prior to commencing any work on a spin-off

IRC 355: Understanding the Basics of a Tax-Free Spin-off. One exception where a corporation is permitted to distribute appreciated property to its shareholders in a tax-free manner is via qualified spin-off under IRC 355. Provided a series of requirements are met, Section 355 can be an excellent option for corporations and their shareholders ...

Background: Section 355 and IRS Ruling Policy On Spinoffs Section 355 provides a limited exception to the general rule that a distribution of appreciated property from a corporation is taxed at both the corporate and shareholder levels. A spinoff of stock in a corporation may take the form of a distribution, redemption, or liquidation.

The taxation of spin-offs, split-offs, and split-ups is governed by Internal Revenue Code 355 (IRC 355). Generally speaking, such events are not taxable when they occur if the company follows certain rules, which are beyond the scope of this article. The most important question to ask is what is my cost basis after a spin-off, split-off, or ...

January 12, 2017 - Paul Hastings is a leading international law firm that provides innovative legal solutions to many of the world's top financial institutions and Fortune Global 500 companies.

What is a tax free spin off? A tax - free spinoff occurs when a company divests a portion of its business in a manner that qualifies as a tax - free transaction under Section 355 of the Internal Revenue Code and thus does not require the company to pay capital gains tax on the divestiture.

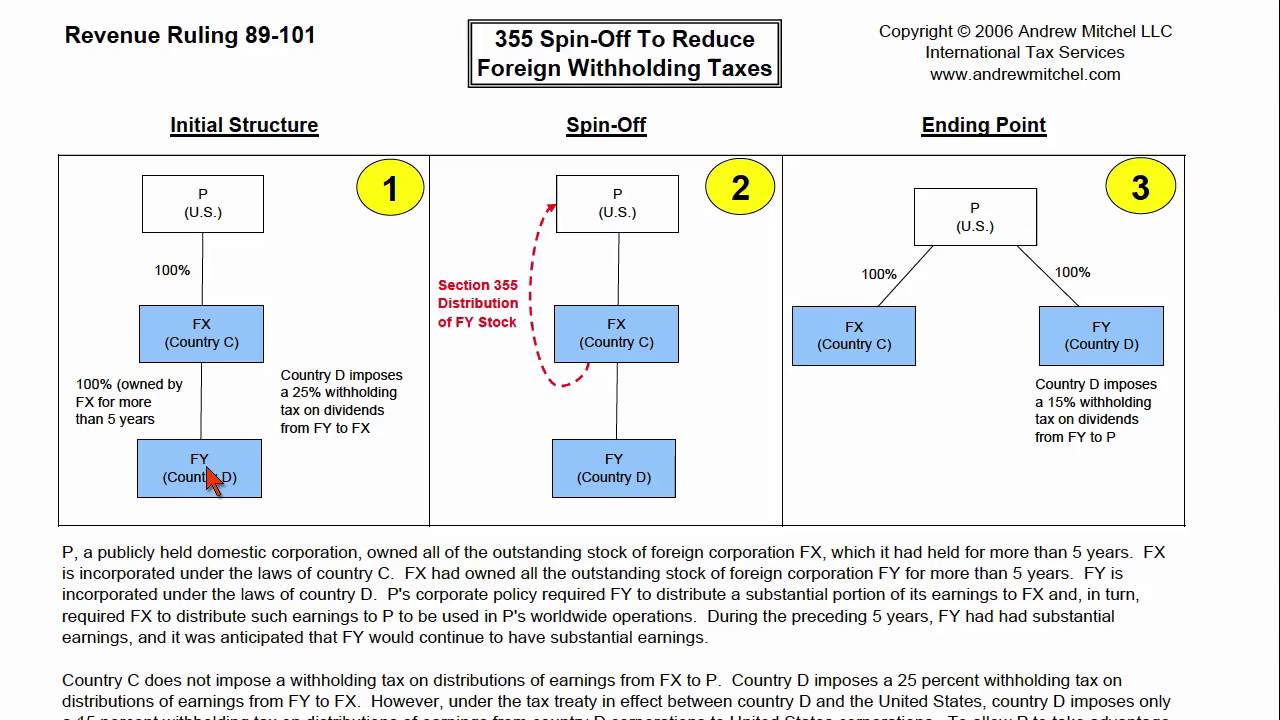

Treasury and the IRS view this type of transaction as a "synthetic spin-off" of the assets that are transferred by the Divided Corporation to Distributing and then to Controlled. The diagram below illustrates an example (Base Case Example) of a synthetic spin-off to which Section 355(e) is intended to apply.

29.03.2021 · Schematic diagram of spin DOS for a HMF. 2. Heusler alloys. In order to employ the Heusler alloy films in spintronic devices, both advantages and disadvantages need to be considered as listed in Figure 3. Both structural and magnetic properties of the Heusler alloys can be controlled by the substitution of constituent elements of the alloy as detailed in the following …

S&C provides the highest quality legal advice and representation to clients around the world. The results the Firm achieves have set it apart for more than 140 years and have become a model for the modern practice of law.

Since the repeal of the General Utilities doctrine in 1986, one of the only ways in which corporations may distribute appreciated property to their shareholders without recognizing corporate-level gain is through the use of spin-off type transactions under section 355 of the Internal Revenue Code. Often, corporations undertake such spin-offs to dispose of unwanted businesses in preparation for ...

The spin-off involves a distribution of property to shareholders without the surrender of any stock, which thus resembles a dividend. The split-off resembles a redemption because the shareholders have relinquished stock of the distributing corporation. Section 355 allows a corporation with ...

A common transaction structure under Section 355 (among other structures commonly referred to as "spin-offs," "split-ups" or "split-offs") that achieves the split is the "divisive D ...

Under Sections 355(d) and 355(e) § 15:2.5 Diagram of a "(D)" Reorganization Spin-Off ... and 355 deal with the spin-off of a newly formed subsidiary. Thus, if the assets to be spun off are not in a single subsidiary, such assets can be contributed to a new subsidiary that will be spun off.

basis of members in an intragroup spin-off to which section 355 applies to reflect appropriately the proper treatment of the spin-off. The House version of proposed section 355(f), we understand, is crafted as a draconian way to prevent a consolidated group from using an intragroup spin to shift tax basis from the stock of one member of the group

Section 355(e) of the Code imposes tax on a spin-off distribution that qualifies under section 355 if the spin-off is linked to a 50-percent-or-greater acquisition of either the spinning corporation or the spun corporation. Under the statute, the required linkage is presumed to exist whenever

IRC Section 355 and its regulatory guidance set the framework for tax deferral on spin-off transcations; failure to comply with these complex rules can mean a significant tax cost if the transaction fails to qualify for deferral treatment. Since announcing it would no longer issue PLRs, the IRS has increased its scrutiny of spin-off ...

October 31, 2019 - In a spin-off, a public company separates one or more of its businesses into a new, publicly traded company. For the public company that initiates it, a spin-off can achieve a number of critical business and financial objectives, including: Potentially achieving a greater valuation multiple ...

03.08.2020 · Nature Photonics - An organic molecule, 5Cz-TRZ, with multiple donor units supports fast reverse intersystem crossing, allowing fabrication of …

June 1, 1998 - ENSURING TAX-FREE TREATMENT While IRC section 355 provides the statutory authority for tax-free treatment of corporate spin-offs, it is the regulatory hoopsparticularly the all-important business purpose requirementthat can cause a companys distribution to fail section 355.

A Tax Executive’s Guide to Spin-offs: 10 Things You Won’t See in Section 355. Advise board and officers to be careful about certain negotiations or public statements during pendency of the spin. by David B. Bailey. November 26, 2019. Behind the closed doors of a corporate boardroom somewhere in America, the directors of a publicly traded ...

The basics of a tax-free spin-off transaction. Section 355 of the Internal Revenue Code provides a powerful tool in corporate restructurings. Under the U.S. corporate income tax system, there is generally a tax imposed both at the corporate level and at the shareholder level. Upon distribution of appreciated property to its shareholders, a ...

The Chevrolet Corvair is a compact car manufactured by Chevrolet for model years 1960–1969 in two generations. It remains the only American-designed, mass-produced passenger car with a rear-mounted, air-cooled engine.The Corvair was manufactured and marketed in 4-door sedan, 2-door coupe, convertible, 4-door station wagon, passenger van, commercial van, and pickup …

-Regulations-Regard/TAX_Sec355eReg_Charts_Graph_1-(1).jpg.aspx)

-Regulations-Regard/TAX_Sec355eReg_Charts-02.jpg.aspx?width=1100&height=589)

0 Response to "36 355 spin off diagram"

Post a Comment