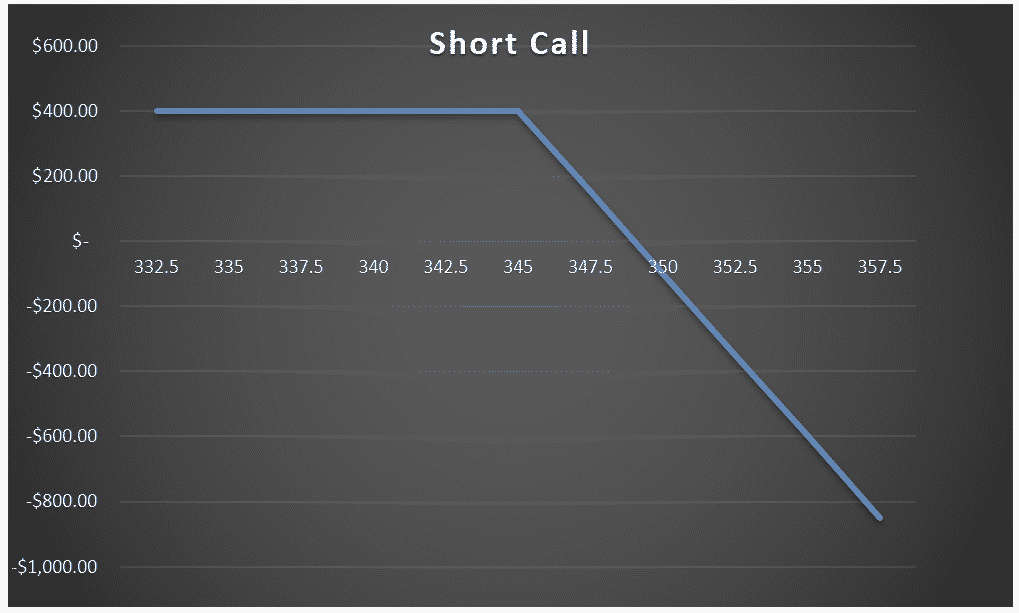

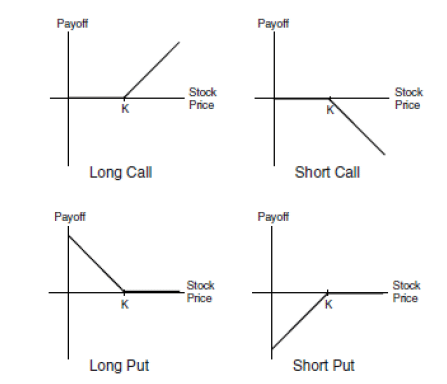

40 short call payoff diagram

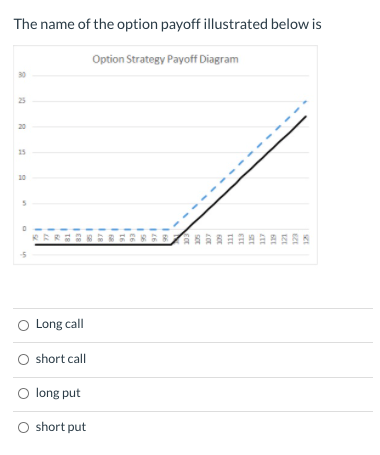

A call spread is an option strategy in which a call option is bought, and another less expensive call option is sold. A put spread is an option strategy in which a put option is bought, and another less expensive put option is sold. As the call and put options share similar characteristics, this trade is less risky than an outright purchase, though it also offers less of a reward. A long call is a net debit position (i.e. the trader pays money when entering the trade). The position profits when the stock price rises. The call buyer has limited losses and unlimited gains, but the potential reward with limited risk comes with a premium that must be paid when entering the position.

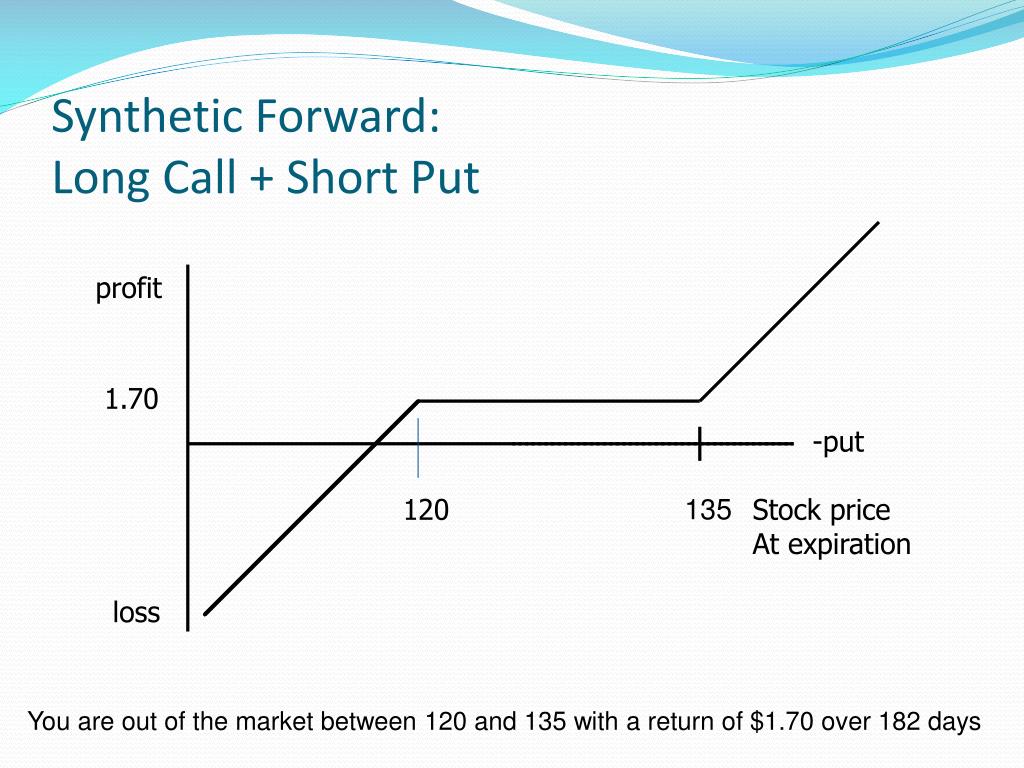

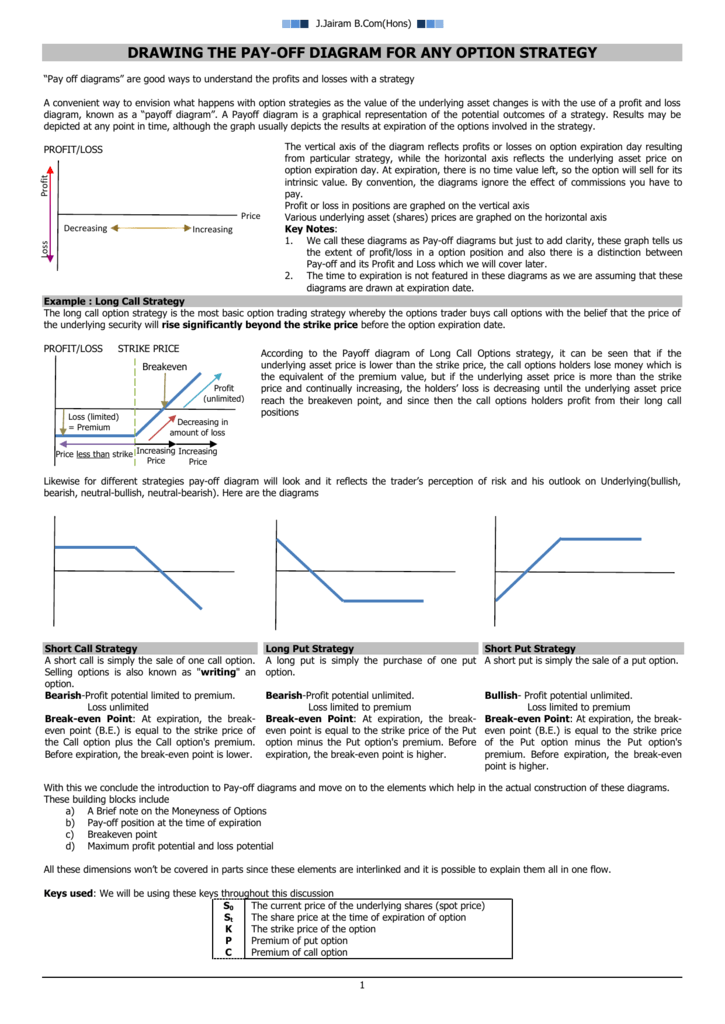

A short put is when a put trade is opened by writing the option. ... A bear straddle is an options strategy that involves writing a put and a call on the same security with an identical expiration ...

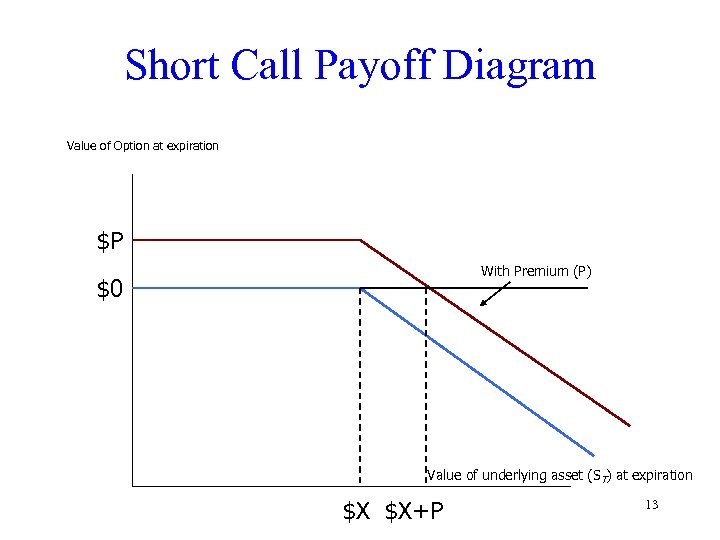

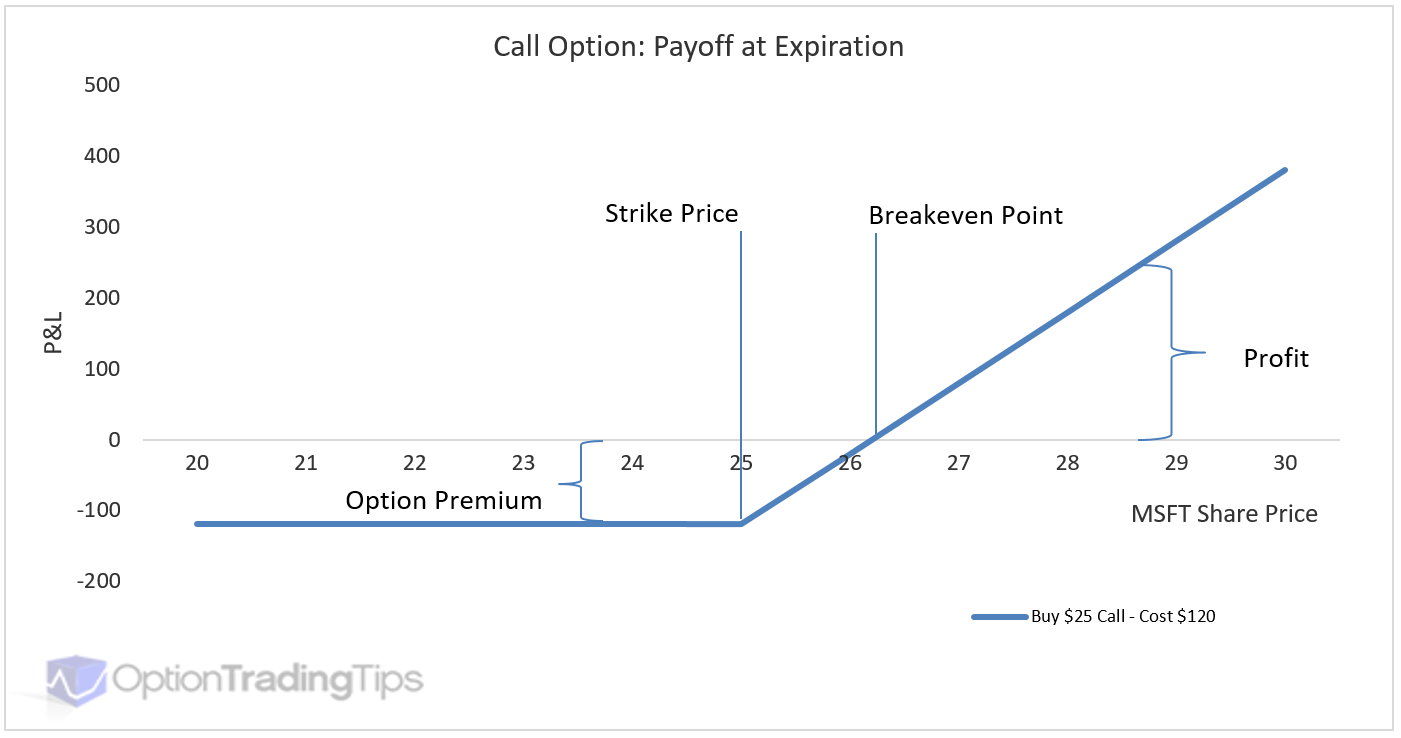

Short call payoff diagram

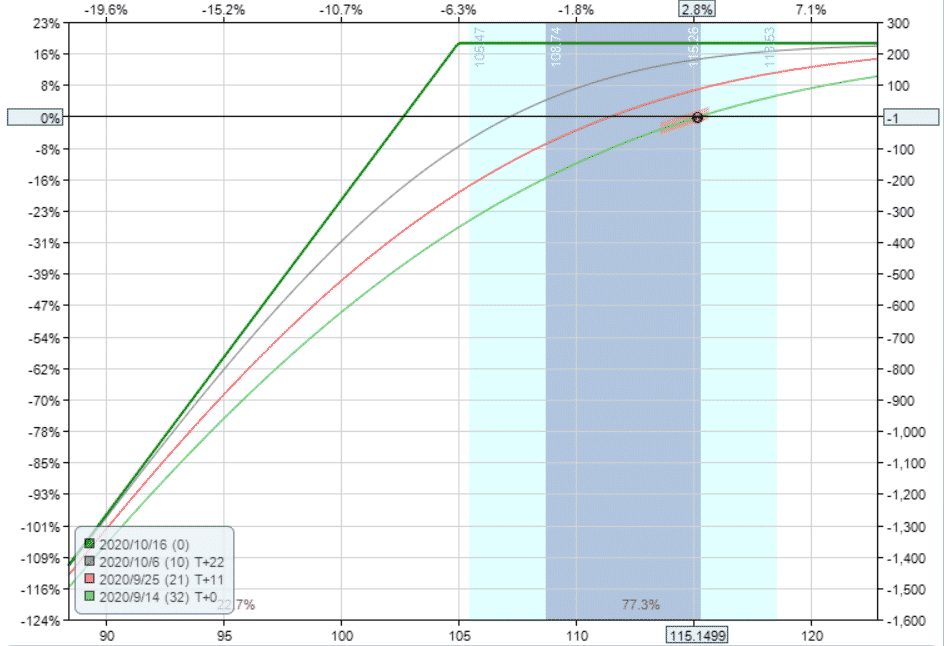

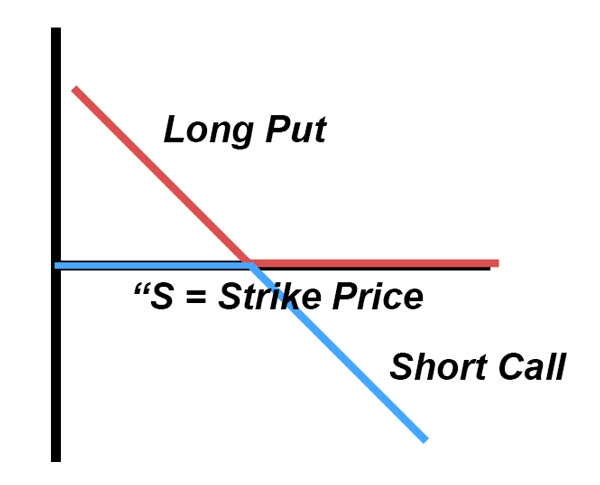

Risk Graph: A two-dimensional graphical representation that displays the profit or loss of an option at various prices. The x-axis represents the price of the underlying security and the y-axis ... An iron condor is an options strategy consisting of two puts (one long and one short) and two calls (one long and one short), and four strike prices, all with the same expiration date. stock currently trading at 212.26 (Spot Price) Option 1: Sell a call with a 215 strike, which gives 7.63 in premium. Option 2: Buy a call with a strike of 220 ... It was a good call—and earned him fame and fortune. In his first exchange patent, US Patent 447,918: Automatic Telephone Exchange , granted March 10, 1891, Strowger described how a traditional switchboard could be replaced by rotating cylinders with lots of connection points on them, which could be turned automatically by electromagnets to ...

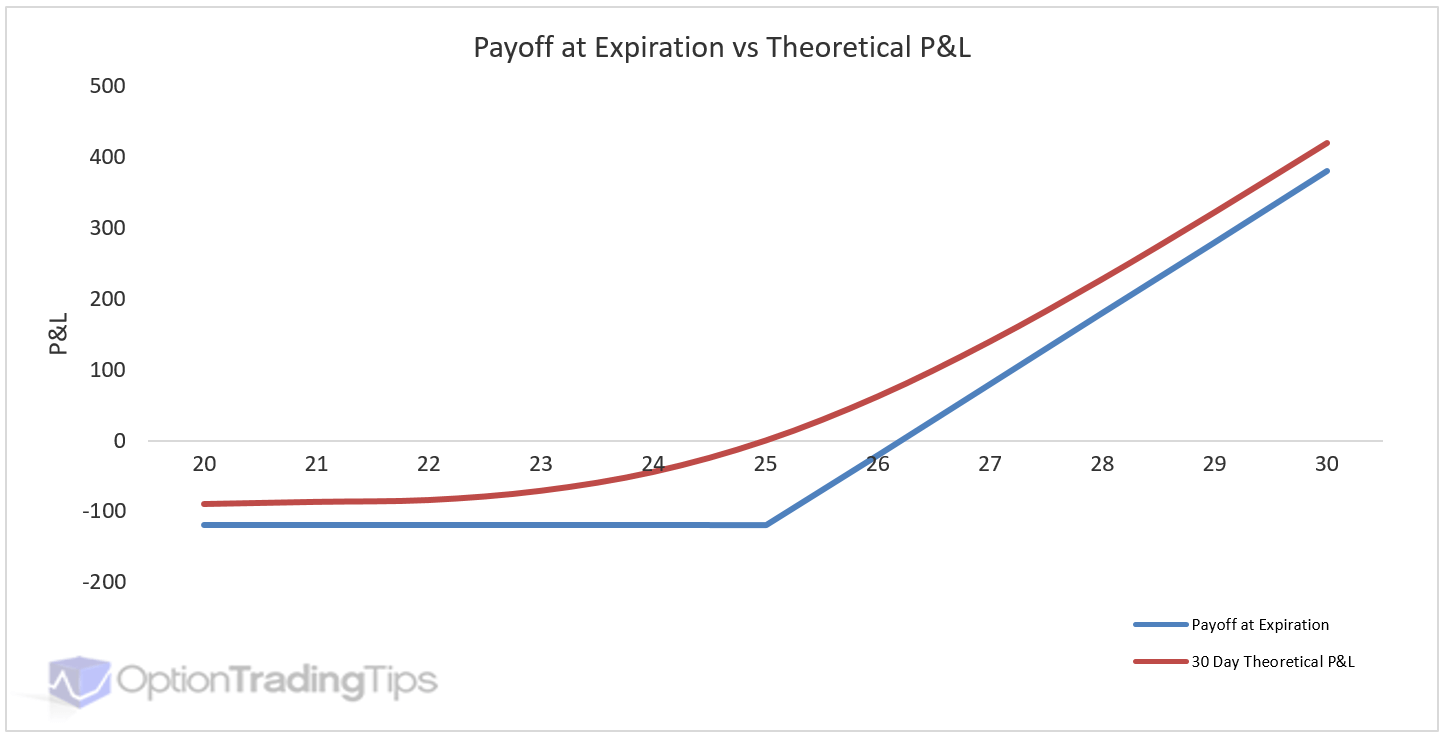

Short call payoff diagram. e. Draw the payoff diagram to the owner of this option with respect to the stock price at expiration. f. Draw the payoff diagram to the seller of this option with respect to the stock price at expiration. g. If the seller of a call option never receives cash at expiration, why would anyone ever sell a call option? And this is what the payoff diagram looks like one day prior to the expiration of the short strike. This is the payoff diagram on July 9, one week prior to the short strike expiration. It is also 29 calendar days into the trade or 40% of the duration of the long option expiration with 71 DTE (days-to-expiration). A long call at strike A, skip strike B, short 3 calls at strike C, and long 2 calls at strike D. Contents Introduction Maximum Loss Maximum Gain Breakeven Price Payoff Diagram The Greeks How Volatility Impacts the Trade How Theta Impacts the Trade Risks Summary Introduction When an investor is long a call, If you set the lower slider bar to 140, this would equal 1 minus the approximate Delta of a 140 strike call or (1 - .5244 = .4756 or 47.56%). Probability of the option expiring above the upper slider bar. If you set the upper slider bar to 145, this would equal the approximate Delta of the 145 call (.3762) or 37.62%. Since 145 is the call you ...

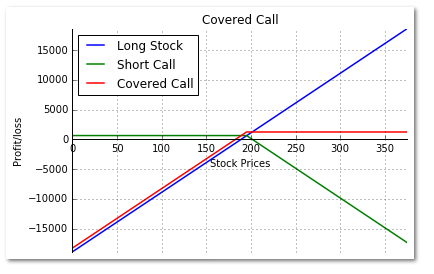

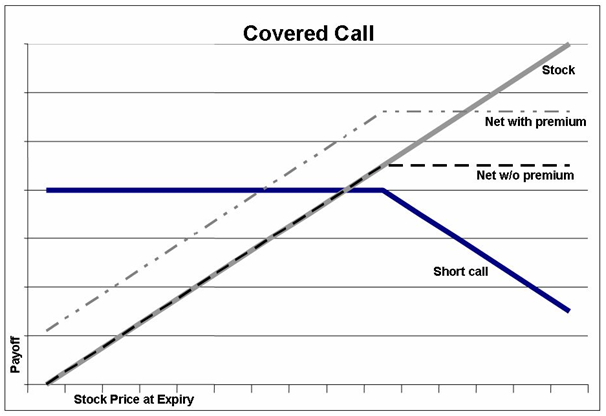

Visualizing the payoff diagram of a covered call Strike Selection and Expiry. To further reduce the risk of our options getting exercised, we can sell call options that expire sooner rather than later, because of how difficult it is to predict how ETH could perform over a longer time frame. 1) Portfolio 1 break-even. Draw the gross and net payoff diagrams for a portfolio which is constructed from buying one call option with a strike price $45.00 and selling one call option with a strike price of $50. The cost of the first option of $7.75 and the cost of the second option is $3.50. Note that, due to put-call parity, the payoff diagram for a covered call is exactly the same as for a cash-secured put. So, depending on whether the strike tick is above or below the current spot price when liquidity was deployed, a Uniswap v3 liquidity position behaves as a short cash-secured put or a covered call. However, when you are short a call, you collect the premium but are exposed to greater risk, which is discussed below. Risks and Rewards . ... Consider the payoff diagram:

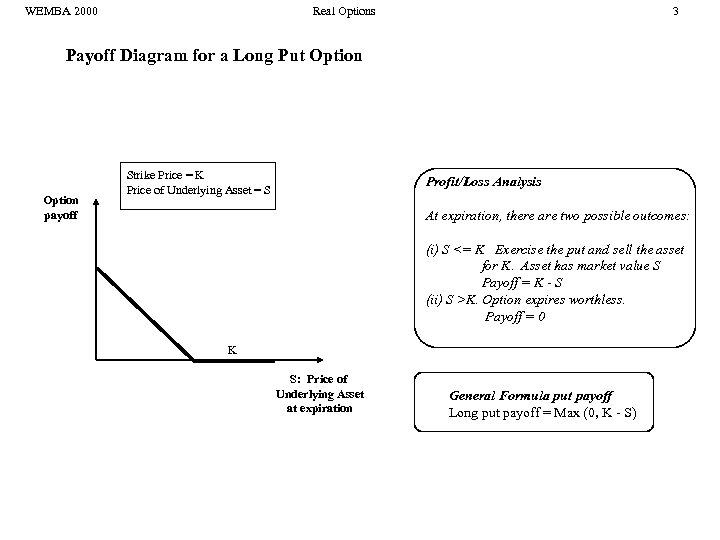

PAYOFF DIAGRAM OF BULL CALL SPREAD. Below is the payoff diagram of a Bull call spread. A key noticeable feature of this diagram is that maximum loss is limited as well as Maximum Profits are limited, making this an excellent tool to go bullish on markets with defined risk. Lower breakeven = Strike price long call (ITM) - net debit paid. Payoff Diagram. Broken wing butterflies have a tent-shaped payoff diagram with the potential for very large profits around the short strike of the calls. It is important to keep in mind it is very unlikely that the trade would achieve the maximum profit. As payoff diagrams show, a call on a stock combined with a short position in the stock gives a payoff similar to a put option. Alternatively we can use put-call parity, which shows that a call minus the stock equals the put minus the present value of the strike price. A strip is a bearish market-neutral strategy that pays off relatively more when the underlying asset declines than when it rises. A strip is essentially a long straddle, but instead utilizes two ...

A short call is a strategy involving a call option, giving a trader the right, but not the obligation, to sell a security. It usually reflects a bearish outlook: an assumption that the price of ...

Option Strategy Builder. Option strategy builder is a tool by intradayscreener.com to help you build option strategies for any stocks in just few clicks. Option trading is very popular these days due to limited risk strategies which helps to manage risk of all traders. Click to Open Advanced Option Strategy Builder.

For a call to remain covered, you have to own the shares until the option expires, which might force you to hold the shares for longer than desired. Net gains are subject to capital gains taxes: You may have to pay short-term or long-term capital gains taxes based on a number of factors.

Options Strategy Simulator computes the payoff and probability of profit (PoP) of one or more combinations of option positions. It presents a very simple, easy-to-use, self-explanatory user interface. Moreover, the data used in the calculations are conveniently provided in .xlsx files. Internally, all the calculations are carried out considering a normal distribution of stock returns…

The payoff diagram is like that of a covered call, with one main difference. You may have noticed that the loss starts to pick up steam once the stock price breaks below the short put strike. This is where the covered strangle has extra risk compared to a covered call because the extra short put means the trader is on the hook to purchase ...

This function will plot each individual payoff diagrams and the resultant payoff diagram. The particulars of each option has to be provided as a list of dictionaries. Example 1: Short Strangle A short strangle is an options trading strategy that involve: (a)selling of a slightly out-of-the-money put and (b)a slightly out-of-the-money call of ...

Short Put Option How To Trade Short Put Payoff Charts Explained Options Futures Derivatives Commodity Trading

Short Strangle (Sell Strangle) he short strangle, also known as sell strangle, is a neutral strategy in options trading that involve the simultaneous selling of a slightly out-of-the-money put and a slightly out-of-the-money call of the same underlying stock and expiration date. The short strangle option strategy is a limited profit, unlimited ...

5. Bear Call Spread: The Bear Call Spread is one of the 2-leg option trading strategies that is implemented by the options traders with a 'moderately bearish' view on the market. This strategy involves buying 1 OTM Call option i.e a higher strike price and selling 1 ITM Call option i.e. a lower strike price.

The payoff diagram of a covered call write strategy where you buy 100 shares of ABC stock at $100 per share and sell a call option on 100 shares with a 100 strike price for $5. As shown, the ...

This sequence diagram tutorial is to help you understand sequence diagrams better; to explain everything you need to know, from how to draw a sequence diagram to the common mistakes you should avoid when drawing one. There are 3 types of Interaction diagrams; Sequence diagrams, communication diagrams, and timing diagrams.

The short call is the secondary position. ... The payoff diagram looks like we are at a good percentage of the max profit, and it is undoubtedly reasonable to take profits. The short call is now in-the-money, and it costs $888 to buy it back. We had sold it for $338. That is a loss of $550.

It was a good call—and earned him fame and fortune. In his first exchange patent, US Patent 447,918: Automatic Telephone Exchange , granted March 10, 1891, Strowger described how a traditional switchboard could be replaced by rotating cylinders with lots of connection points on them, which could be turned automatically by electromagnets to ...

An iron condor is an options strategy consisting of two puts (one long and one short) and two calls (one long and one short), and four strike prices, all with the same expiration date. stock currently trading at 212.26 (Spot Price) Option 1: Sell a call with a 215 strike, which gives 7.63 in premium. Option 2: Buy a call with a strike of 220 ...

Risk Graph: A two-dimensional graphical representation that displays the profit or loss of an option at various prices. The x-axis represents the price of the underlying security and the y-axis ...

Short Call Option How To Trade A Short Call Payoff Charts Explained Options Futures Derivatives Commodity Trading

/dotdash_Final_Call_Apr_2020-02-cf56d3cf2d424ade8f6001fa23883a3c.jpg)

/dotdash_Final_Short_Put_Apr_2020-01-c4073b5f97b14c928f377948c05563ef.jpg)

0 Response to "40 short call payoff diagram"

Post a Comment