40 generation skipping trust diagram

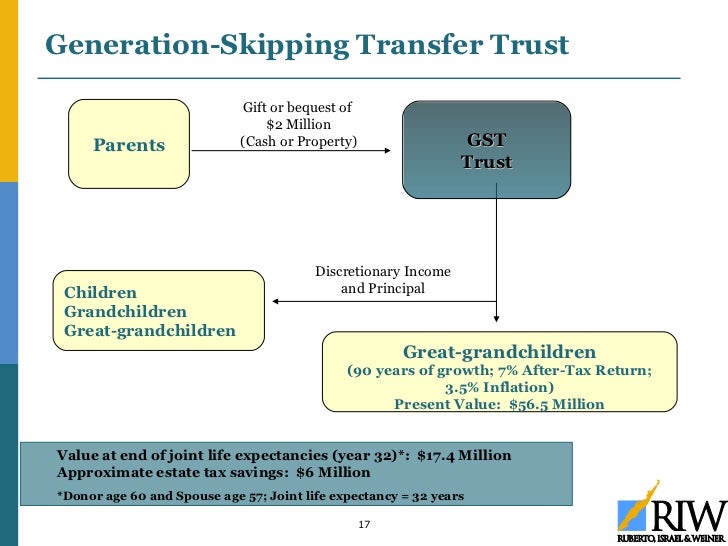

The generation-skipping tax exemption is a flat $5.25 million this year (it is also indexed for inflation). if you and your spouse are worth more than about $5 million AND you plan on leaving your assets to grandchildren, or in trusts for your children lasting past their deaths, then you might not want to rely on the portability arrangement. 24.07.2021 · diabetes1type ⚡quotes. 2. Correct hyperglycemia: Continuous IV insulin infusion should be administered at 0.1 unit/kg/hr. No “bolus” or loading dose is necessary. When the serum glucose reaches 250 mg/dL, dextrose should be added to the IV fluids and insulin should be continued until the ketoacidosis completely resolves.

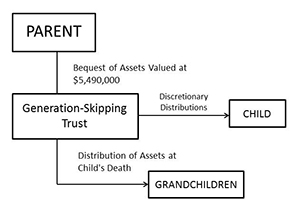

The generation-skipping tax exemption allows you to leave a certain amount in trust for your beneficiaries so that these inheritances are not taxed again when the beneficiaries die. Despite talk that both the estate tax and generation-skipping tax might be eliminated, this change does not appear likely.

Generation skipping trust diagram

James "Jimmy" Brooks is a Class of 2007 graduate of Degrassi Community School. He was seen as the school basketball star during his time at Degrassi. He also comes from a wealthy family, as he is shown with many high-end gifts. Despite this, Jimmy was among the more open-minded, humble students at Degrassi. He had a habit of being unusually antagonistic towards Sean Cameron until Season 3 ... The trust further could be shielded by the donor-spouse's generation-skipping transfer (GST) tax exemption if intended for grandchildren and more remote descendants. • The assets transferred to the trust by the donor should be made from the donor's separate property and not from jointly titled or That's why we also offer qualified (and non-qualified) Charitable Remainder Trusts (CRTs), Irrevocable Life Insurance Trusts (ILITs), Family Limited Partnerships (FLPs) and certain Add-on formats/subtrusts such as Trust Investment Advisor provisions, Qualified Plan QTIP Trusts, Medicaid Qualifying Trusts, Special Needs Trusts, Generation Skipping Trusts, and more

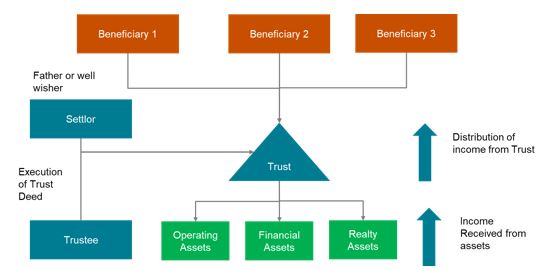

Generation skipping trust diagram. $ wget --trust-server-names https: ... If really nothing seems to work, consider skipping the Windows version and using Scapy from a Linux Live CD – either in a virtual machine on your Windows host or by booting from CDROM: An older version of Scapy is already included in grml and BackTrack for example. While using the Live CD you can easily upgrade to the latest Scapy version by using the ... A generation-skipping trust is a type of trust that designates a grandchild, great-niece or great-nephew or any person who is at least 37 ½ years younger than the settlor as the beneficiary of the trust. The goal of a generation-skipping trust is to eliminate one round of estate tax. Generation-skipping trusts offer tax advantages through the ... A generation-skipping trust, sometimes referred to as a "dynasty trust," is exactly what it sounds like, a legally binding, specialized, irrevocable trust agreement in which a grantor's assets are passed down to the grantor's grandchildren, but not children, to avoid estate tax liability. GSTs are designed to eliminate estate taxes at each generational level for as many generations as ... That's what a "Generation-Skipping Transfer" Trust, or "GST" trust does. It is a trust which is designed to avoid estate taxation at the death of the beneficiary. During the life of the beneficiary, the assets in the trust are used for their health, education, maintenance, and support.

This limitation applies to both simulation and Simulink Coder™ code generation. The maximum number of characters that a parameter edit field can contain is 49,000. Block-Specific Parameters and Programmatic Equivalents. The tables list block-specific parameters for Simulink blocks. The type of the block appears in parentheses after the block name. Some Simulink blocks work as masked ... History Pre-CTA era. The first "L", the Chicago and South Side Rapid Transit Railroad, began revenue service on June 6, 1892, when a steam locomotive pulling four wooden coaches, carrying more than a couple of dozen people, departed the 39th Street station and arrived at the Congress Street Terminal 14 minutes later, over tracks that are still in use by the Green Line. 30.12.2020 · Trust were lower than in April for every institution/figure (Biden, Trump, CDC, Fauci, News media, social media, state gov, police, etc); trust scientists/ researchers much more than president. 73% Democrats who trust Trump and 84% of Republicans who trust Biden would vaccinate their children. 8/25–8/27 (1 of 2) STAT/The Harris Poll : 2067 The Current Law. Thanks to recent changes in the tax law, each person may now transfer approximately $11.2 million free of this generation skipping tax. For a married couple, the amount is effectively $22.4 million. The maximum tax rate for GST, Gift and Estate taxes is now 40%. Combined Tax Rates. In the event GST tax is imposed together with ...

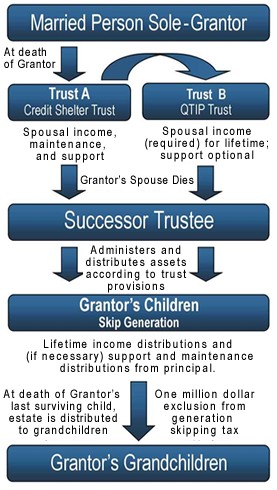

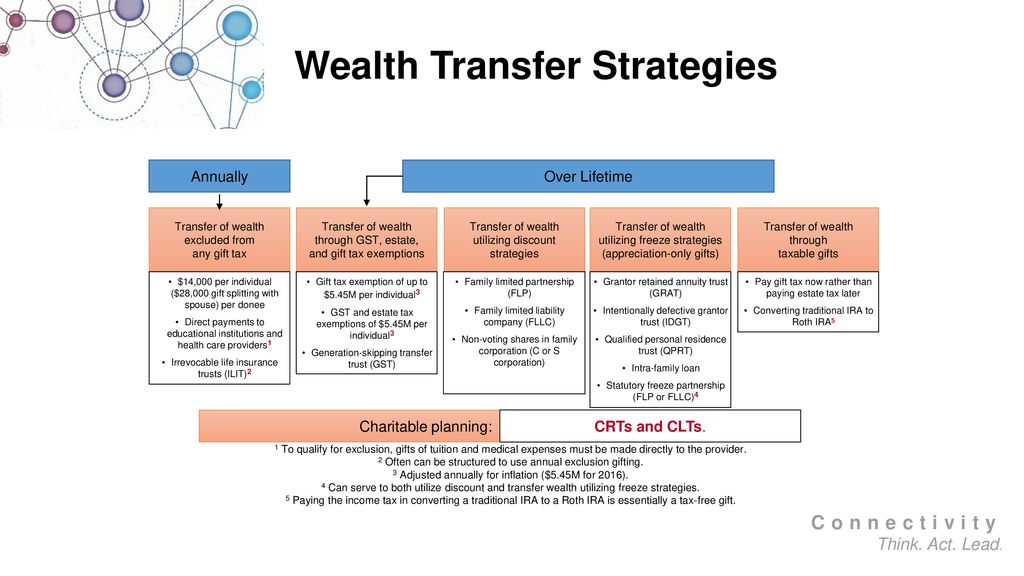

You can fund a generation-skipping trust with up to $5.45 million in 2016 and allocate your lifetime exemption to the trust in order to avoid future GST tax liability. Once the trust is funded and ... A generation-skipping trust is a useful tool for those with especially large estates. It allows you to give money directly to younger friends or family members, saving your family some estate tax payments down the line. Up to $11.40 million per person is subject only to the estate tax, while any funds greater tjam that amount are also subject ... irrevocable generation-skipping trusts created and funded during the transferor's life. The transferor's executor can allocate it to deathtime transfers to the extent that any exemption remains unused at the time of the transferor's death. GENERATION-SKIPPING PLANNING WITH FORMULA GIFTS 30 A. In General 30 B. Basic Three Trust Plan 31 1. EXPLANATION OF PLAN 31 2. SAMPLE LANGUAGE 31 3. DIAGRAM OF ... DIAGRAM 2 -- Two Trust Plan (Tax Paid at First Death) 46 DIAGRAM 3 -- Two Trust Plan (No Tax at First Death) 47

generation-skipping transfer tax to trigger the application of Section 2041(a)(3) or Section 2514(d) of the Code. III. HOW IS THE INCOME EARNED IN DYNASTY TRUSTS TAXED? A. Overview. A trust may be taxed as a grantor trust for federal income tax purposes under Sections 671 - 678 of the Internal Revenue Code ("IRC") or a non-grantor trust

Cause Related Marketing Brand Loyalty And Corporate Social Responsibility A Cross Country Analysis Of Italian And Japanese Consumers Emerald Insight

A generation-skipping trust (GST) is a type of legally binding trust agreement in which the contributed assets are passed down to the grantor's grandchildren, thus "skipping" the next generation ...

Note, however, that the beneficiary need not be a grandchild in order for the IRS to classify a trust as generation skipping. Under IRS rules, a trust skips a generation anytime the beneficiary is ...

Where a single trust contains assets attributable to more than one transferor, the trust will be treated as 2 or more separate trusts for generation-skipping transfer tax purposes. I.R.C. § 2654(b)(1). Each portion of that single trust attributable to a different transferor will be a separate trust. Id. The division of the underlying assets ...

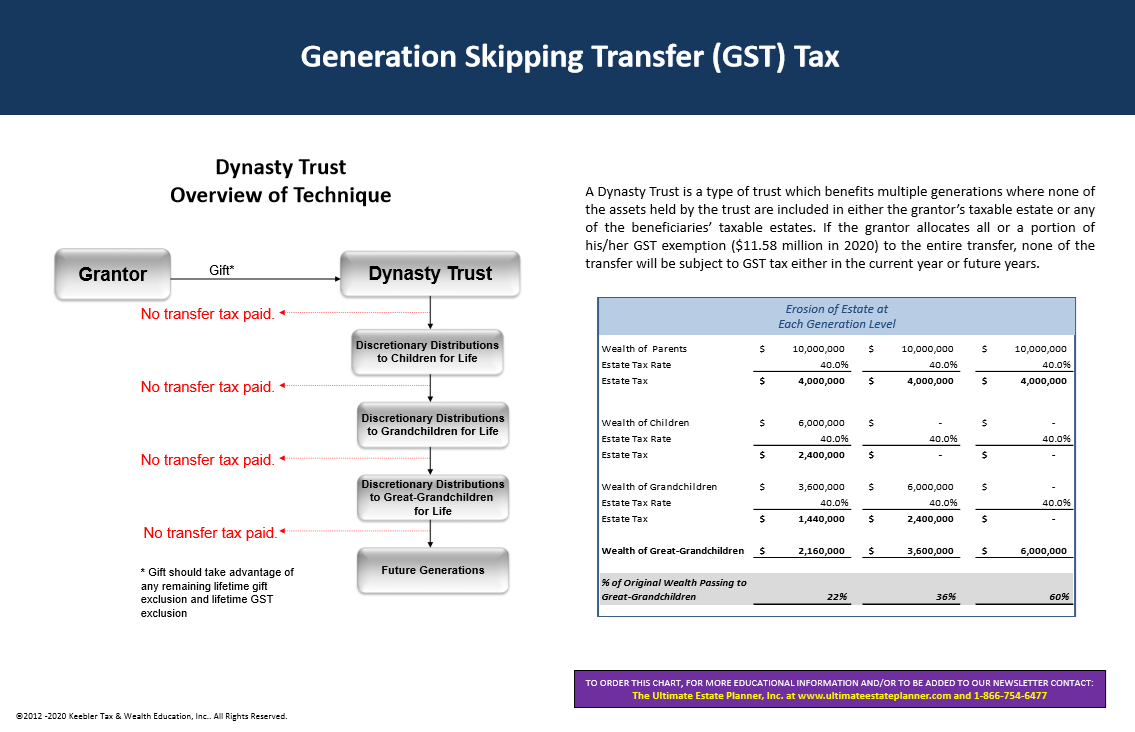

Dynasty trust (also known as a 'generation-skipping trust'): A type of trust in which assets are passed down to the grantor's grandchildren, not the grantor's children. The children of the grantor never take title to the assets. This allows the grantor to avoid the estate taxes that would apply if the assets were transferred to his or her children first. Generation-skipping trusts can still be ...

The generation skipping tax exemption is $5,450,000 (adjusted for inflation each year) as is the gift tax exclusion exemption. In the case of a transfer to a trust which will continue for one or more generation members below that of the grantor, a gift tax return should be filed and generation skipping tax exemption shall be allocation.

trusts can exist without the trust or beneficiaries paying US federal estate, gift, or generation-skipping transfer tax. However, to date, such efforts have been unsuccessful and the GRAT lives on as a popular and effective estate planning tool.

A dynasty trust is a long-term trust created to pass wealth from generation to generation without incurring transfer taxes, such as estate and gift taxes. They are often used by very wealthy families to take advantage of the generation-skipping tax exemption of $11.7 million (in 2021). In order to act as a dynasty trust, the trust must be kept ...

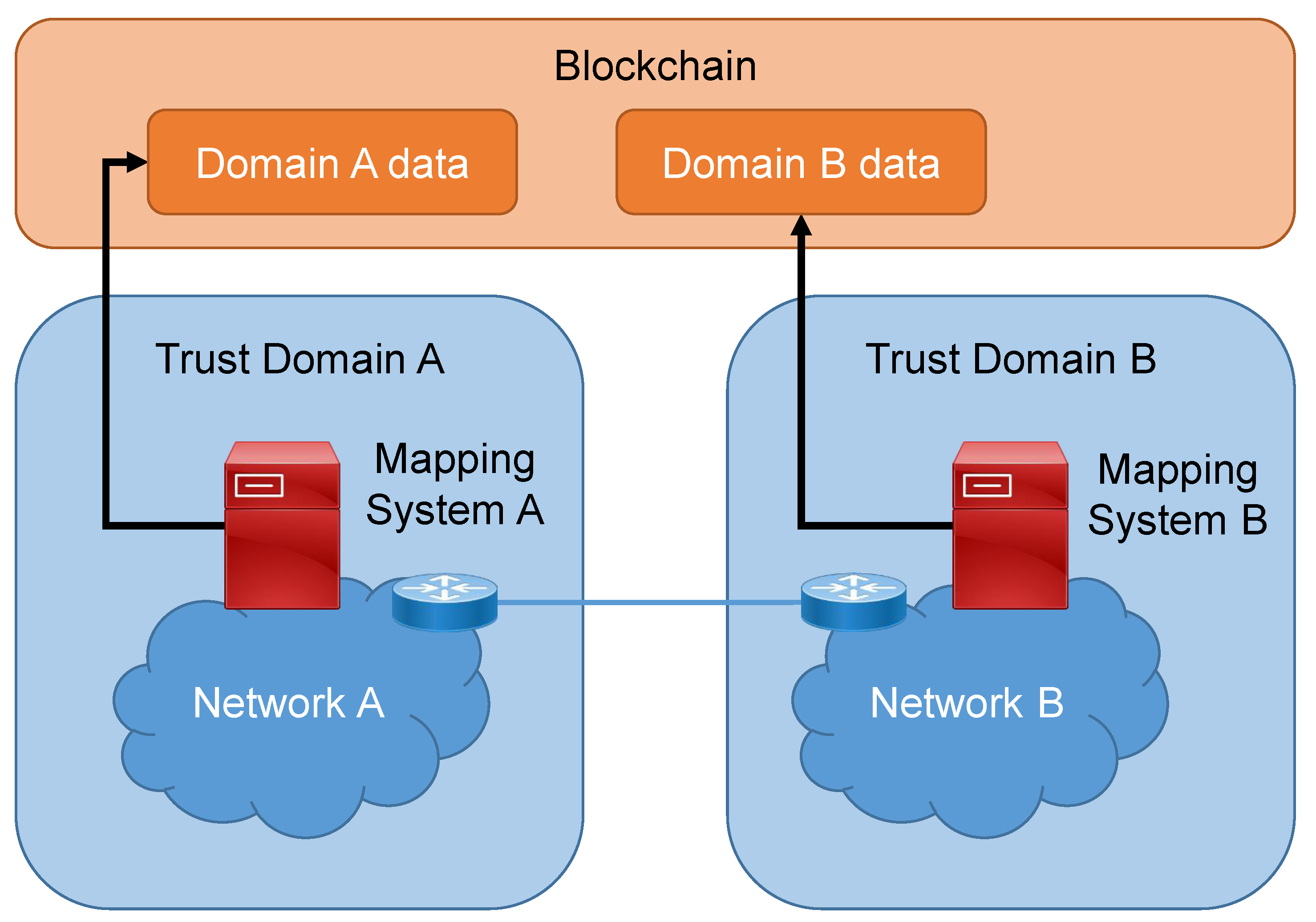

Applied Sciences Free Full Text Results And Achievements Of The Alliance Project New Network Solutions For 5g And Beyond Html

Dynasty Trust: ILITs known as Dynasty Trusts can be used for Generation-Skipping transfer (GST) tax planning and may last for several generations, unlike a traditional ILIT.6 The Dynasty Trust can give each generation access to the trust assets (such as for health, education, maintenance and support), while keeping the

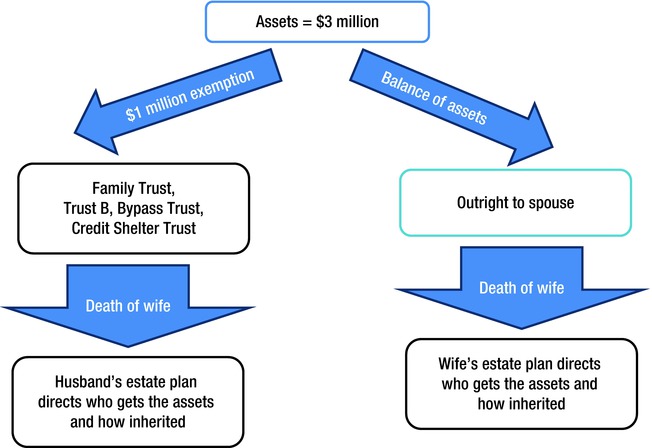

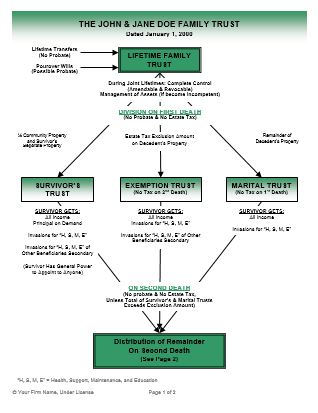

For years, married couples have used AB trusts to maximize the amount of assets they pass to their heirs free of estate tax. See this AB trust diagram for a refresher on how AB trusts work. When the estate tax exemption amount was only $2,000,000 per person several years ago, an AB trust arrangement was necessary just to pass $4,000,000 to heirs fee of estate tax.

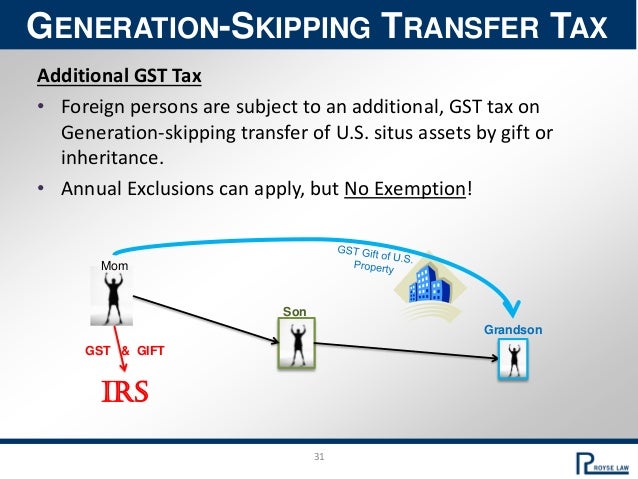

The generation-skipping transfer tax is an additional tax on a transfer of property that skips a generation. The United States has taxed the estates of decedents since 1916. Gifts have been taxed since 1924 and, in 1976, Congress enacted the generation-skipping transfer (GST) tax and linked all three taxes into a unified estate and gift tax.

enacted the generation skipping transfer (GST) tax, which imposes an additional 40% tax on transfers which skip a generation. 2. Similar to the gift/estate tax exemption, there is a GST tax exemption in the same amount ($5.34M this year). The same Credit Shelter Trust which preserves the estate

The donor spouse can also use the SLAT as a tool to allocate his or her generation-skipping transfer tax exemption to the trust funds. Lastly, the main advantage of a SLAT versus any other irrevocable trust is that there is some level of access to the trust property for the donor spouse, via distributions to the beneficiary spouse, should a ...

Therefore, without the use of a CST, any unused state estate tax exclusion and generation-skipping transfer tax exclusion of the first spouse to die will be lost. Assets contained in a trust are generally protected from the beneficiary's creditors.

In The Five Dysfunctions of a Team Patrick Lencioni once again offers a leadership fable that is as enthralling and instructive as his first two best-selling books, The Five Temptations of a CEO and The Four Obsessions of an Extraordinary Executive.This time, he turns his keen intellect and storytelling power to the fascinating, complex world of teams.

Federal Estate, Gift, and GST Tax. Below is a summary of the current federal estate, gift, and generation-skipping transfer tax provisions for 2021. Note that, under current law, the increases in exemption amounts that began in 2018 are set to expire in 2026, at which point they will revert back to the pre-2018 numbers (i.e., $5,490,000 per ...

This trust can remain sheltered for an extended period of time (around 100 years). Even when the inheritance is relatively small (say, $100,000 to $200,000), the ability to protect these assets is valuable. A second but important benefit of the generation-skipping trust is the creditor-protection it affords to the heirs. Consider these points:

The Role Of Knowledge Trust And Religiosity In Explaining The Online Cash Waqf Amongst Muslim Millennials Emerald Insight

Integrated Trust Systems. <table border=0 cellpadding=0 cellspacing=0 width="100%"> <tr><td><table border=0 cellpadding=0 cellspacing=0 width="100%"> <tr><td><a ...

The 1986 Act imposed a tax equal to the highest estate tax rate on any generation- skipping transfer, with a $1 million exemption per taxpayer. In 1995, the exemption was indexed for inflation in $10,000 increments. In 2001, the exemption was increased to match the estate tax exemption. This change, along with scheduled increases in the ...

The generation-skipping transfer tax taxes assets that skip a generation such as a gift by a grandparent to a grandchild. If the combined amount you might leave to skip-persons such as grandchildren is likely to be more than the GST exemption, you might want to consider retaining a bypass trust to ensure that the first spouse to die's GST tax ...

A generation-skipping trust is an estate planning tool designed to transfer assets in a way that avoids some estate taxes. This type of trust, through which assets skip a generation, is also called a GST trust or dynasty trust, because it is often used by affluent families to pass down wealth at a great estate tax savings.

That's why we also offer qualified (and non-qualified) Charitable Remainder Trusts (CRTs), Irrevocable Life Insurance Trusts (ILITs), Family Limited Partnerships (FLPs) and certain Add-on formats/subtrusts such as Trust Investment Advisor provisions, Qualified Plan QTIP Trusts, Medicaid Qualifying Trusts, Special Needs Trusts, Generation Skipping Trusts, and more

2017 Estate Gift And Gst Tax Update What This Means For Your Current Will Revocable Trust And Estate Plan The National Law Review

The trust further could be shielded by the donor-spouse's generation-skipping transfer (GST) tax exemption if intended for grandchildren and more remote descendants. • The assets transferred to the trust by the donor should be made from the donor's separate property and not from jointly titled or

James "Jimmy" Brooks is a Class of 2007 graduate of Degrassi Community School. He was seen as the school basketball star during his time at Degrassi. He also comes from a wealthy family, as he is shown with many high-end gifts. Despite this, Jimmy was among the more open-minded, humble students at Degrassi. He had a habit of being unusually antagonistic towards Sean Cameron until Season 3 ...

0 Response to "40 generation skipping trust diagram"

Post a Comment