36 loan origination process flow diagram

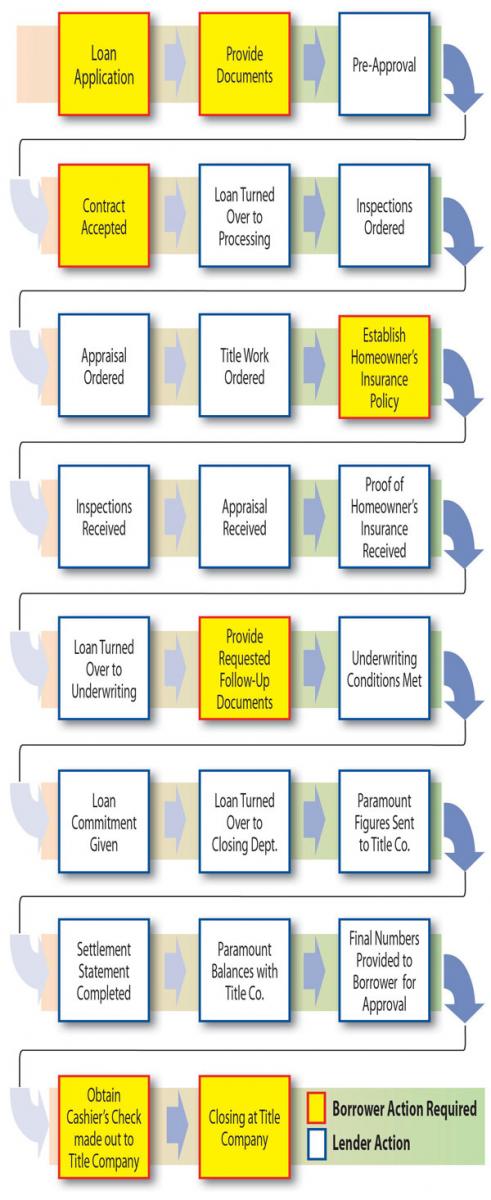

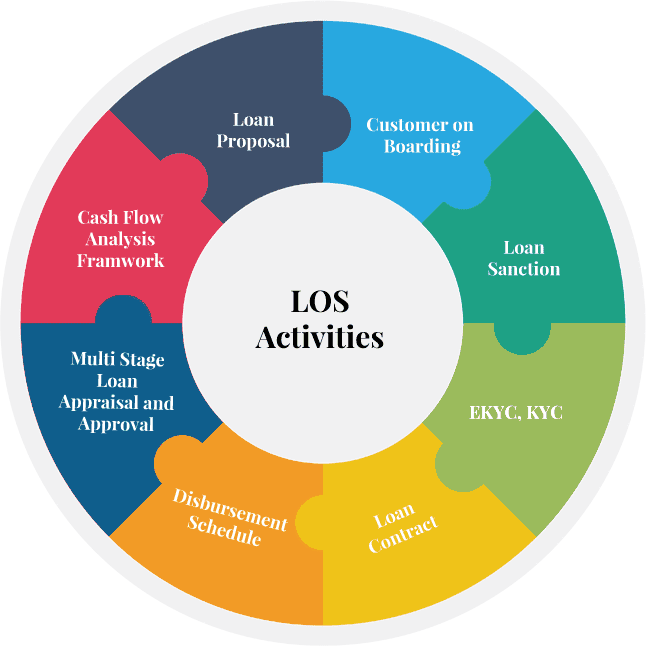

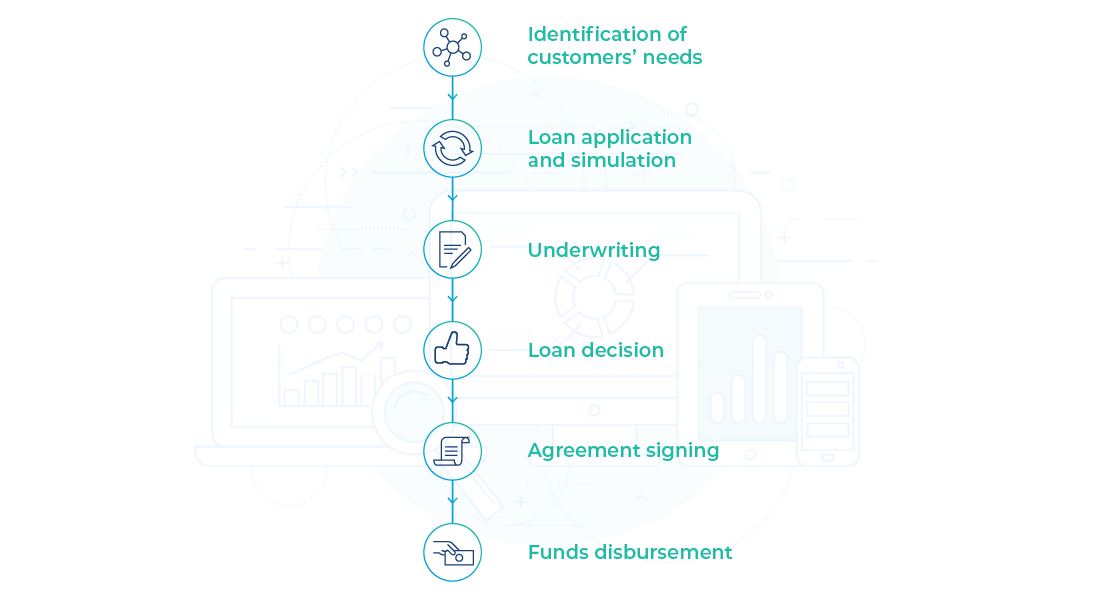

The Corporate Loan origination process flow is composed of following stages: • Application Entry • Application Verification • Underwriting • Loan Approval • Document Verification • Customer, Collateral, Facility, Loan, Account Creation The maintenances and the different stages in the process flow are explained in detail in the Common Mistakes to Avoid. How is a Property Appraised. Five Facts About Rate Locks. Four Facts About Rate Shopping. Loan Processing Flow Chart. Free Boxes. Free Moving Boxes. Test. Accessibility Statement.

2. Corporate Loan Origination 2.1 Introduction. The process of loan origination gets initiated when a prospective customer approaches the bank, with a loan account opening request or when the bank approaches a prospective customer, taking lead from its database.

Loan origination process flow diagram

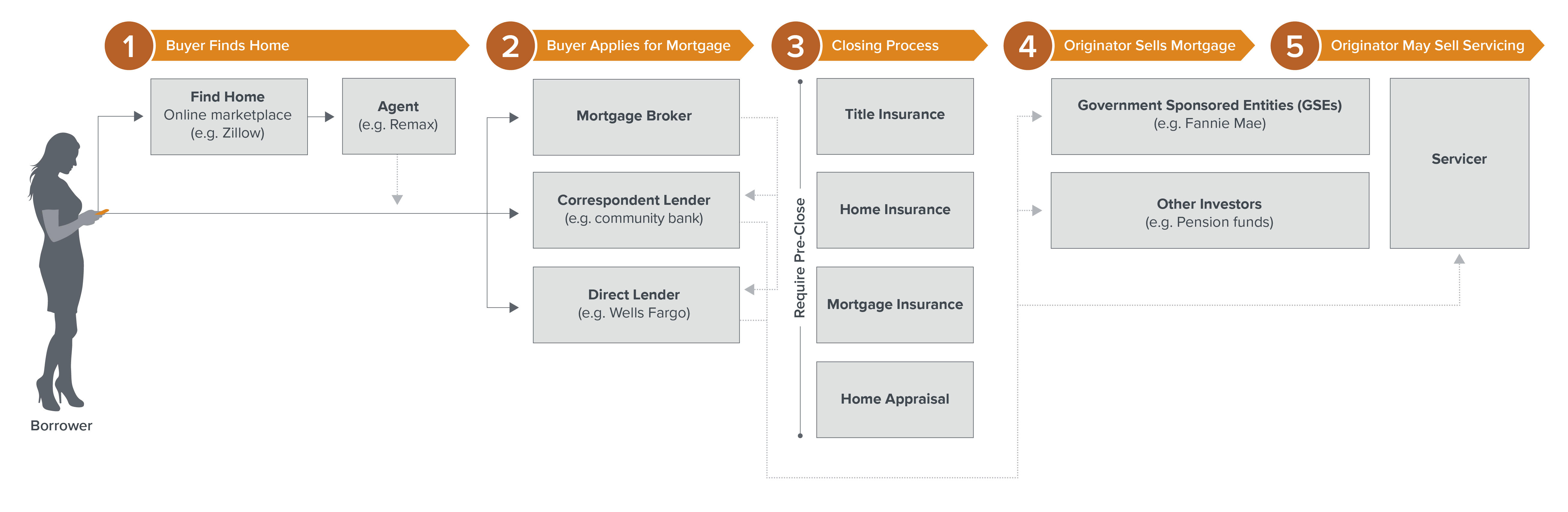

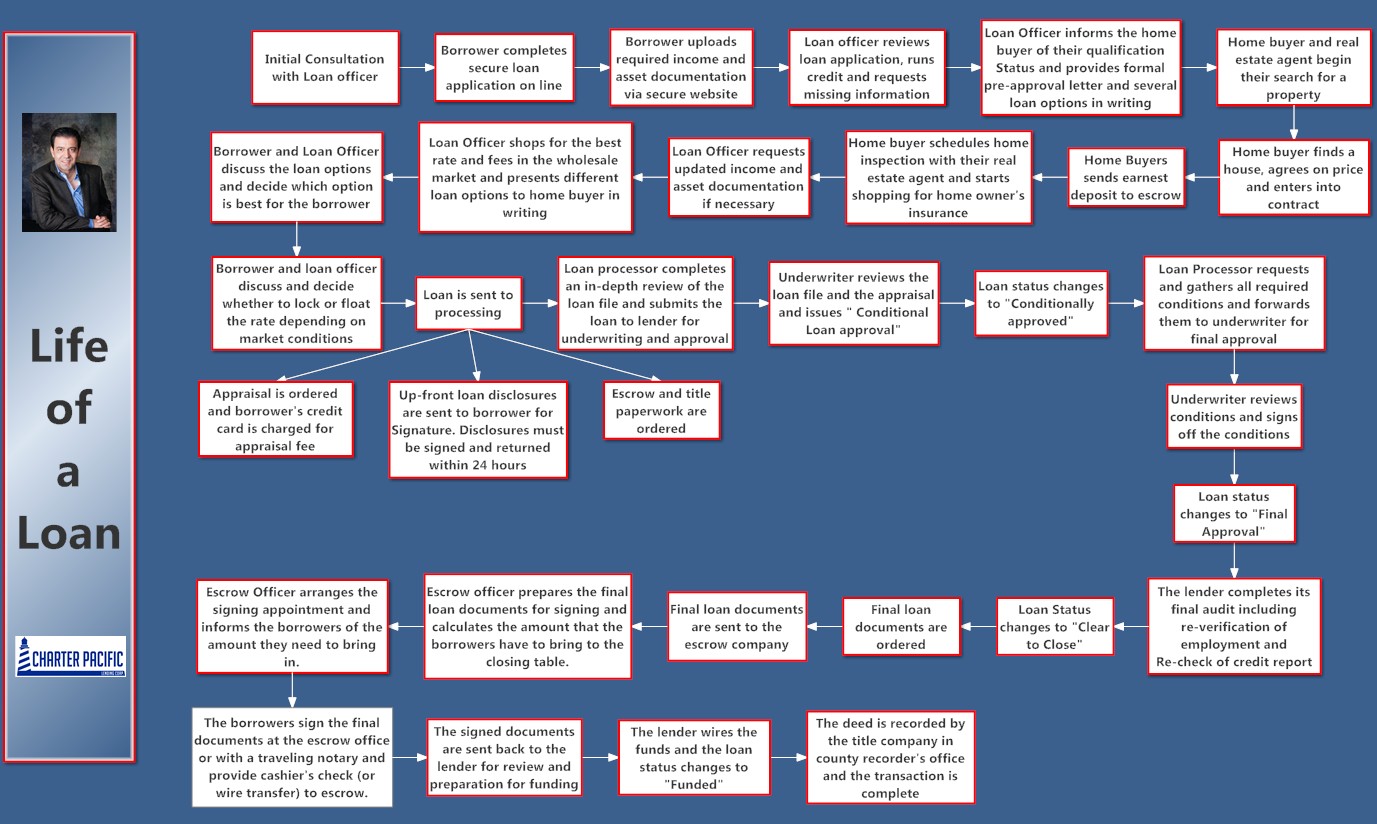

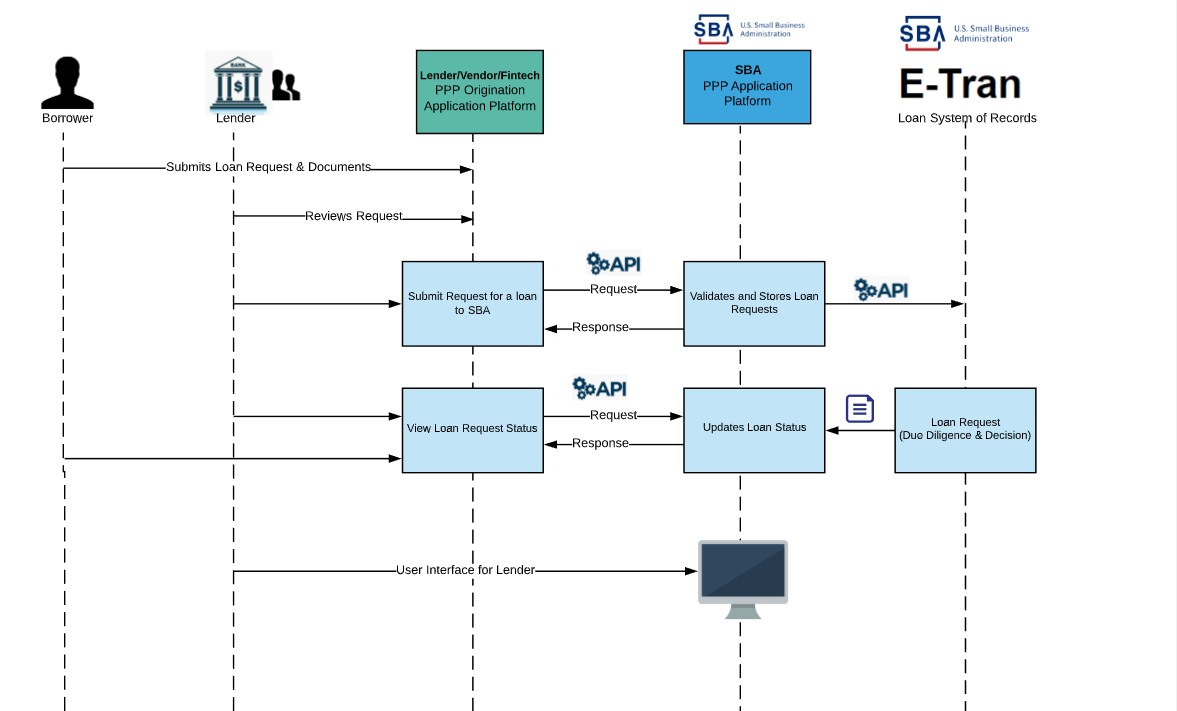

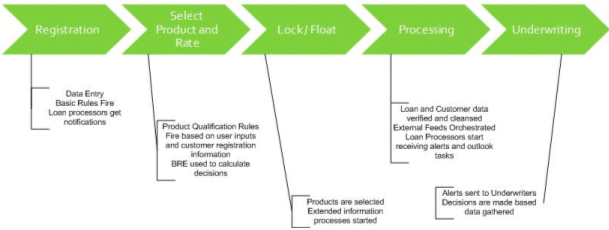

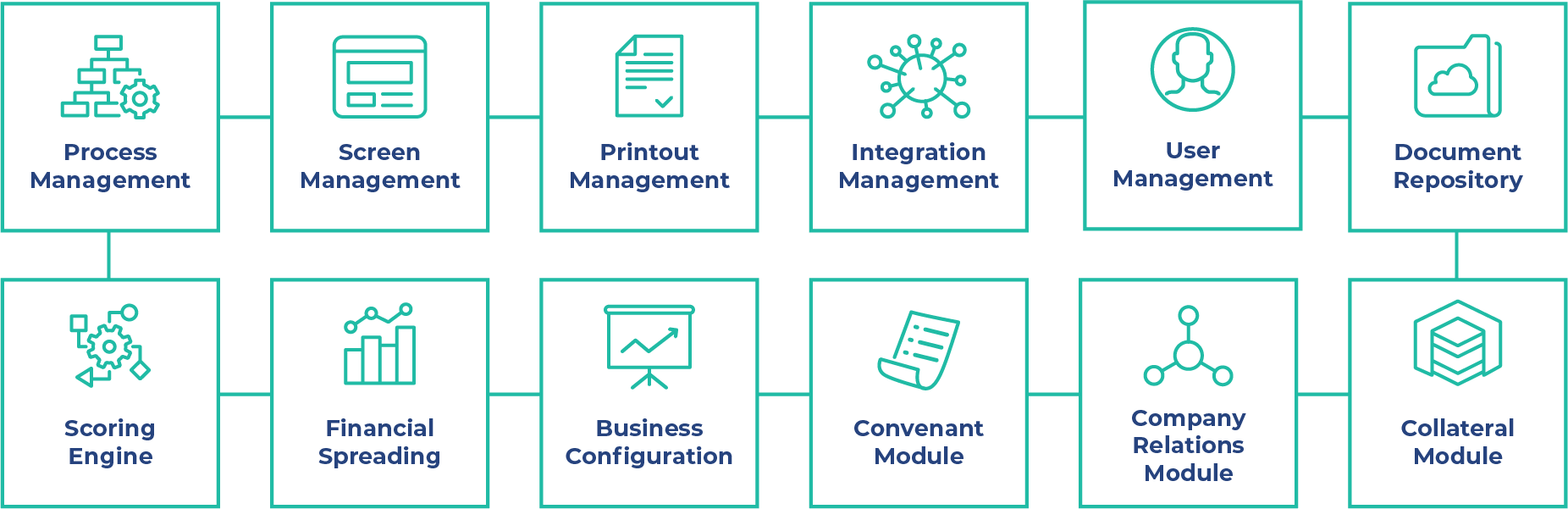

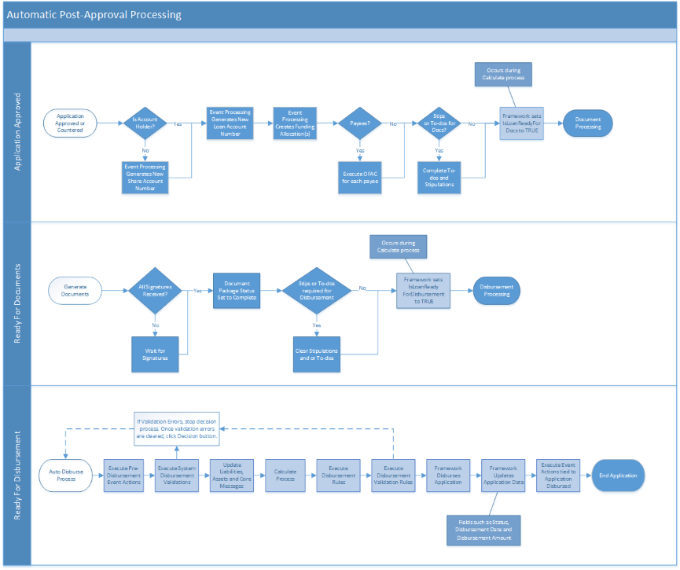

Loan Workflow Models; Loan Validation Models; Loan Decision Models; Field Configurations; Loan Officer Approval Limits; Stipulations; Fees; Calculate or Event ... Loan origination process flow diagram. While maintaining control of the flow and making sure no required steps are being missed. Loan origination is the process by which a borrower applies for a new loan and a lender processes that application. Retail lending process flow uses oracle bpel framework with multiple human tasks for workflow stages. The mortgage loan origination process flow begins when a borrower fills out an application. These days, those applications are almost always digital, but the rest of the borrowing experience may not be. If it is, it’s usually not part of an end-to-end system that seamlessly connects that first application with the rest of the process. We’re ...

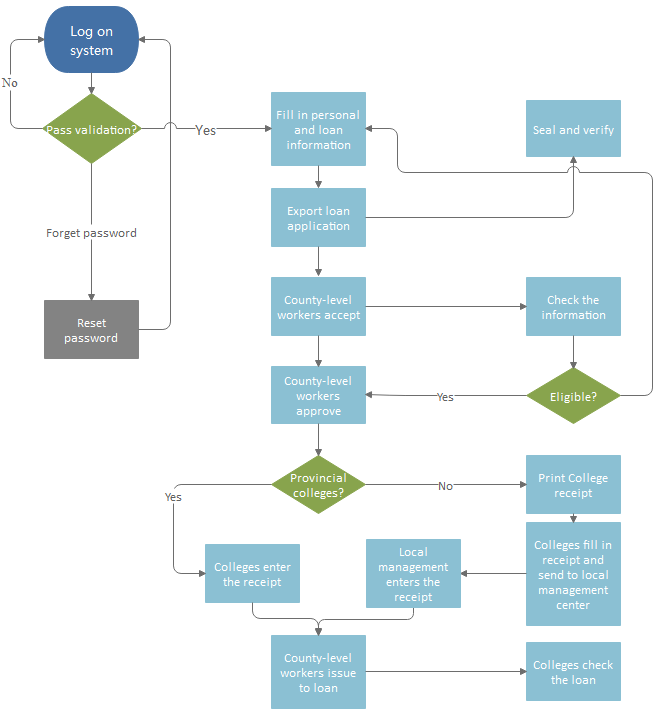

Loan origination process flow diagram. Flow chart for loan management is a diagram which uses vector symbols to visually depict the managing process. It helps customer managers to go on those steps one by one without miss any steps and follow up borrowers easily to avoid bad loans. Edraw Flowchart Maker is a professional application for creating flow chart for loan management. Users ... The mortgage loan origination process typically includes all the steps leading up to, and including, the successful closure and funding of a mortgage loan. The process is triggered when a borrower inquires about a loan, or when a lead is generated through the bank’s marketing channels. On average, this process takes anywhere from 30 – 60 days. 1) Pre-Qualification Process : This is the first step in the Loan origination process. At this stage, the potential borrower will receive a list of items they need to submit to the lender to get a loan. This may include : • ID Proof / Address proof: Voter ID, AADHAR, PAN CARD. • Current Employment Information including Salary slip. GFE Process Flowchart Borrower visits a loan originator 1 Borrower s name Social Security number ... Rate free loan origination process flow diagram form.

the loan Funds at closing, or same day, the checks are cut by the title company, and keys are delivered. For Refinances, the borrower has a 3 day Right of Rescission, or ability to cancel the transaction within that time. Once this time has passed, the loan is considered officially closed and will move to Funding, where payoffs to existing Completed. Approve for Funding. Completed. Book Loan. Approved. Decline Email Sent. Completed. Completed. Send Decline Email. (automated). Loan is Booked.1 page of the process. Your loan is in the final stages before closing. The documents are being prepared for the final closing disclosure. 7 CLOSING Contact your Title Agent/ Attorney conducting the closing to schedule a convenient time to close. Your Loan Processor or Mortgage Loan Originator will provide you with the amount needed for closing (or a ... The mortgage loan origination process flow begins when a borrower fills out an application. These days, those applications are almost always digital, but the rest of the borrowing experience may not be. If it is, it’s usually not part of an end-to-end system that seamlessly connects that first application with the rest of the process. We’re ...

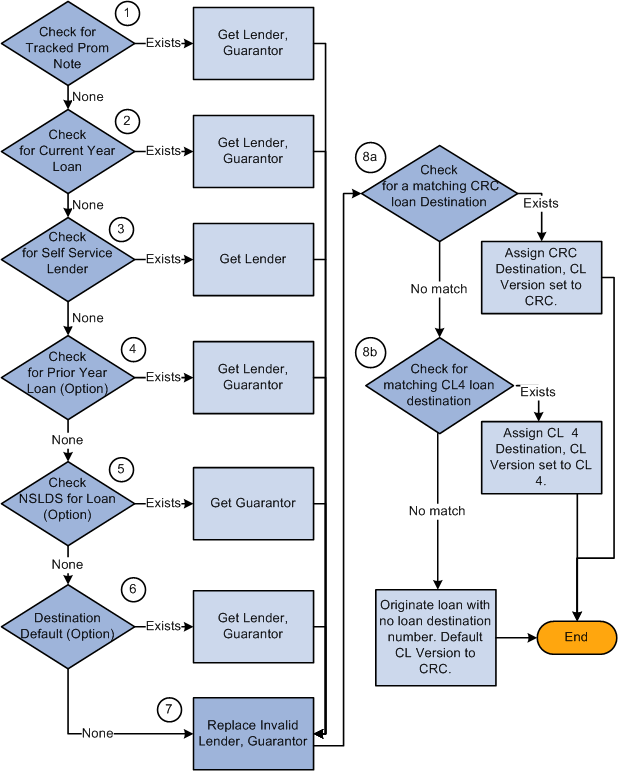

Loan origination process flow diagram. While maintaining control of the flow and making sure no required steps are being missed. Loan origination is the process by which a borrower applies for a new loan and a lender processes that application. Retail lending process flow uses oracle bpel framework with multiple human tasks for workflow stages. Loan Workflow Models; Loan Validation Models; Loan Decision Models; Field Configurations; Loan Officer Approval Limits; Stipulations; Fees; Calculate or Event ...

Pdf A Workflow Instance Based Model Checking Approach To Analysing Organisational Controls In A Loan Origination Process Semantic Scholar

A Flowchart Showing Loan Application And Processing Flowchart You Can Edit This Flowchart Using Creately Diagramming T Loan Application Flow Chart Application

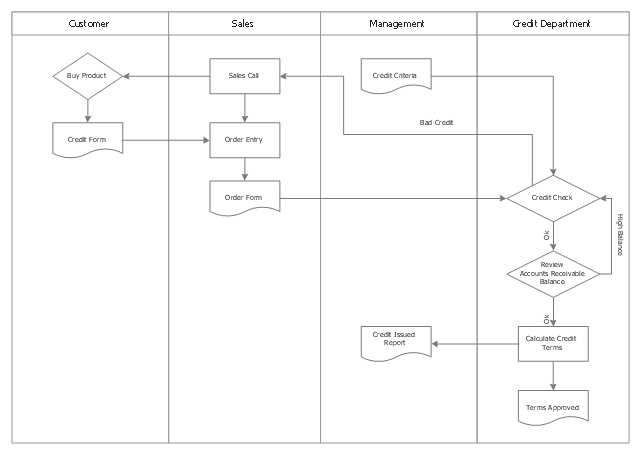

Process Flow Credit Approval Flowchart On Bank Flowchart Examples Business Process Modeling With Conceptdraw Loan Process Flow Chart Swim Lanes

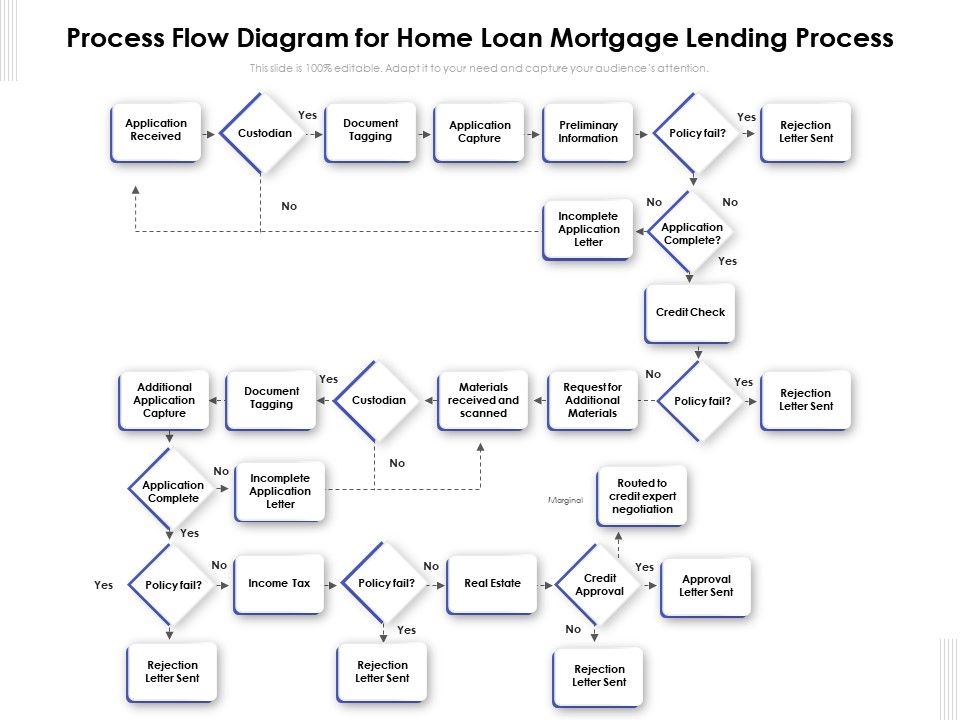

Process Flow Diagram For Home Loan Mortgage Lending Process Presentation Graphics Presentation Powerpoint Example Slide Templates

Loan Application And Processing Flowchart The Flowchart Explains The Application And Proce Process Flow Chart Template Process Flow Chart Flow Chart Template

0 Response to "36 loan origination process flow diagram"

Post a Comment